MPAC encourages better understanding of property assessments

Plain-language insert card explains property values for 2021 and 2022

June 16, 2021

The Municipal Property Assessment Corporation (MPAC) is providing additional information to Ontario property owners on property assessment notices being sent out this year.

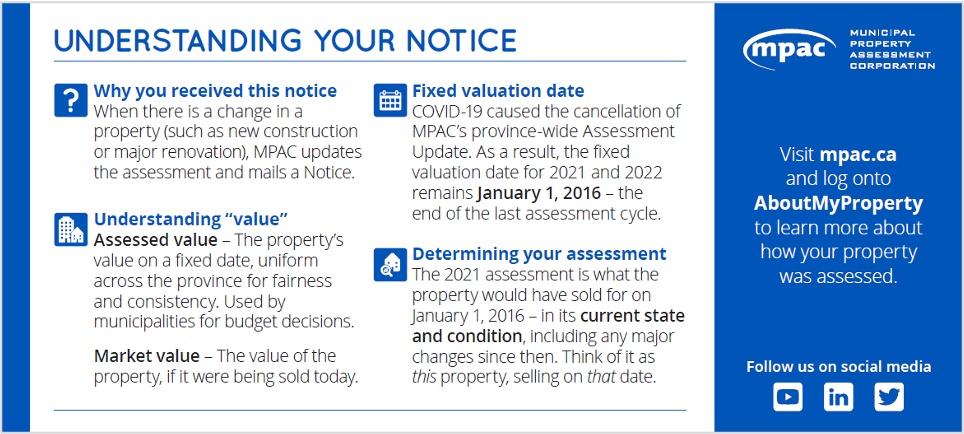

Starting this spring, the notices – which are sent to any property owner whose property has changed, such as new ownership or structures being added, removed or renovated – include a specially designed insert card. The plain-language insert (see image below) explains why the property owner is receiving the notice, along with details about the valuation process.

“It’s important for property owners to understand their assessments, which are vital inputs into municipal decisions,” says Carmelo Lipsi, MPAC Vice President and Chief Operating Officer. “Especially since the COVID-19 pandemic disrupted MPAC’s regular assessment cycle, we feel now is a good time to clarify how property values are determined.”

The insert, which was included with more than 38,000 notices distributed in May, notes that MPAC’s property assessments are based on a fixed valuation date, uniform across the province. The fixed date ensures consistency and fairness for every community, with all municipalities starting at the same point for budget decisions such as property tax rates.

Because MPAC’s 2020 province-wide Assessment Update was postponed, January 1, 2016 continues to be the fixed date set by the Government of Ontario for MPAC to determine assessed values for this year.

“The assessed value ensures a level playing field, with all municipalities working from the same baseline,” Lipsi explains. “This is different from market value – the selling price for a property today – which is impacted by ongoing marketplace fluctuations. Assessed value, determined on a fixed date, provides a stable input specifically for municipal budget decisions.”

When determining the assessed value, MPAC considers what a property, in its current state, would have sold for on the fixed date. If upgrades to the property (such as adding a swimming pool or a major renovation) have been made since then, those upgrades are taken into account as if they had been in place on January 1, 2016.

Municipal decisions on 2021 and 2022 property tax rates will be based on this data. Assessments are being updated, and property assessment notices sent, for properties that have changed. Otherwise, a property’s previous assessed value will continue to apply.

“Our priority at all times is getting the assessment right,” Lipsi says. “If a property owner believes the assessment is not accurate, MPAC will review it free of charge.”

The fastest and easiest way to file a Request for Reconsideration is online through AboutMyProperty. Property owners can visit mpac.ca and register for AboutMyProperty using their Roll Number and Access Key found on their Property Assessment Notice. The deadline to file a Request for Reconsideration for the 2022 property tax year is printed on each Notice.

About MPAC

MPAC is an independent, not-for-profit corporation funded by all Ontario municipalities, accountable to the Province, municipalities and property taxpayers through a 13-member Board of Directors.

Our role is to accurately assess and classify all properties in Ontario in compliance with the Assessment Act and regulations set by the Government of Ontario. We are the largest assessment jurisdiction in North America, assessing and classifying more than five million properties with an estimated total value of $3 trillion.

For additional information, visit www.mpac.ca.