MPAC Fact Sheet

About MPAC

The Municipal Property Assessment Corporation (MPAC) is an independent, not-for-profit corporation funded by all Ontario municipalities.

Our role is to accurately assess and classify all properties in Ontario. We do this in compliance with the Assessment Act and regulations set by the Government of Ontario.

We are the largest assessment jurisdiction in North America, maintaining an inventory of more than 5.6 million properties with an estimated total value of more than $3.1 trillion.

We are accountable to the Province, municipalities and property taxpayers of Ontario through a 13-member Board of Directors. The Board of Directors is comprised of provincial, municipal and taxpayer representatives appointed by the Minister of Finance.

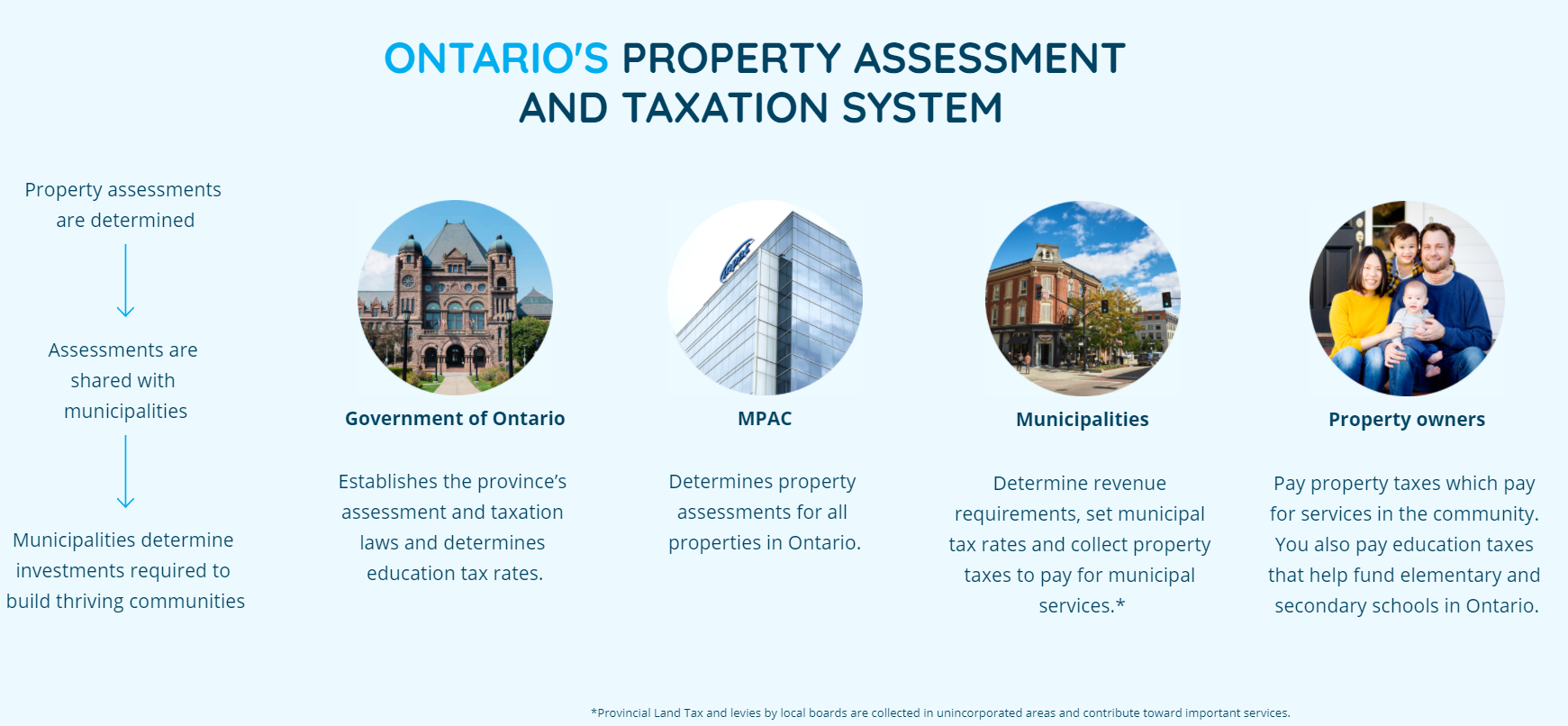

Ontario’s Property Assessment and Taxation System

Property assessments are determined --> Assessments are shared with municipalities --> Municipalities determine investments required to build thriving communities

Each component of Ontario's property assessment system plays an important role.

The Government of Ontario establishes the province's assessment and taxation laws and determines education tax rates.

MPAC determines property assessments for all properties in Ontario.

Municipalities determine revenue requirements, set municipal tax rates and collect property taxes to pay for municipal services.*

Property owners pay property taxes which pay for services in the community. You also pay education taxes that help fund elementary and secondary schools in Ontario.

*Provincial Land Tax and levies by local boards are collected in unincorporated areas and contribute toward important services.

Assessment Cycle

MPAC completes a province-wide Assessment Update every four years based on a legislated valuation date. The valuation date, established by the Ontario government, is a fixed day on which all properties are valued.

The last province-wide Assessment Update took place in 2016, based on a January 1, 2016 valuation date. In 2020, the province-wide assessment update was postponed due to the COVID-19 pandemic. As part of the Ontario Economic Outlook and Fiscal Review, on November 4, 2021, the Province announced its decision to postpone the assessment update again. Property assessments for the 2025 property tax year continue to be based on January 1, 2016 assessed values.

Assessment and Property Taxes

Annual property assessment increases are revenue neutral, which means they have no impact on the total property tax amount that a municipality might raise. Rather, these changes provide for a redistribution of property taxes within a municipality, based on the value of the property owned.

Learn more in this video: https://www.youtube.com/watch?v=nrWry5i3TBU

Current Value Assessment

To establish a property’s assessed value, MPAC analyzes sales of comparable properties in the area. This method, called Current Value Assessment (CVA), is used by most assessment jurisdictions in North America. In addition, we look at all of the key features that affect market value. When assessing residential properties 200 different factors are considered, however five major factors account for approximately 85% of the value: location, lot dimensions, living area, age of the property, adjusted for any major renovations or additions, and quality of construction.

More Information

AboutMyProperty – A tool designed for property taxpayers to explain how MPAC has assessed their property and similar properties in their neighbourhood. AboutMyProperty also provides information about how MPAC assesses different types of properties: Residential, Farm, Multi-residential and Business. We encourage property owners with questions about their assessment to access this valuable resource.

Learn how your property taxes are calculated based on the assessed value of your home – An MPAC video resource to help demonstrate the link between property assessment and your municipal taxation process.