Reading Your Property Assessment Notice

Property assessments for the 2026 property tax year will continue to be based on January 1, 2016 current values. Learn more about the continued postponement of the province-wide Assessment Update.

We continue to update property information during non-Assessment Update years. Notices are mailed to property owners throughout the year to inform them of changes made to their property information. Learn more about the Notices and Notifications we send and why you might receive one.

When you receive your Property Assessment Notice

When you first receive your Property Assessment Notice (or any notice from us), you should read it carefully and advise us immediately if you disagree with any of the information. Here's how to advise us that you:

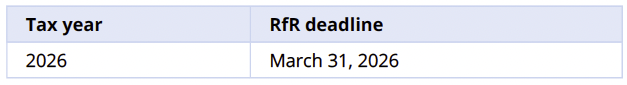

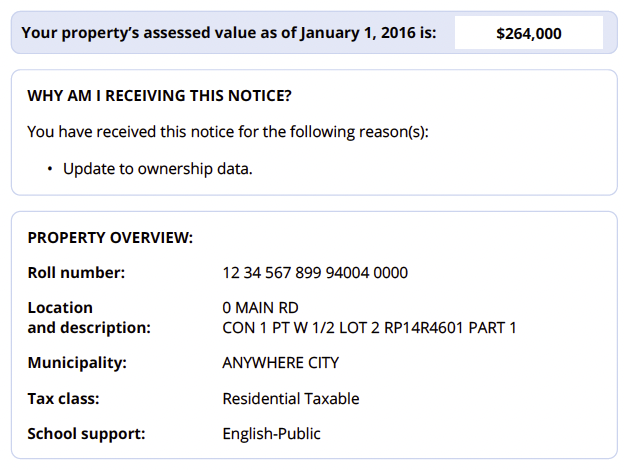

How to read your Property Assessment Notice

While you may receive a different notice depending on your property type, all our Property Assessment Notices have information about your property, including:

- assessed value

- reason(s) for receiving your notice

- roll number

- location and description

- municipality or local taxing authority

- classification

- school support

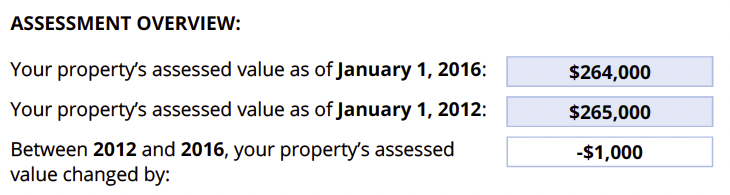

Assessed value change

You can also see how your property value has changed since the last assessment.

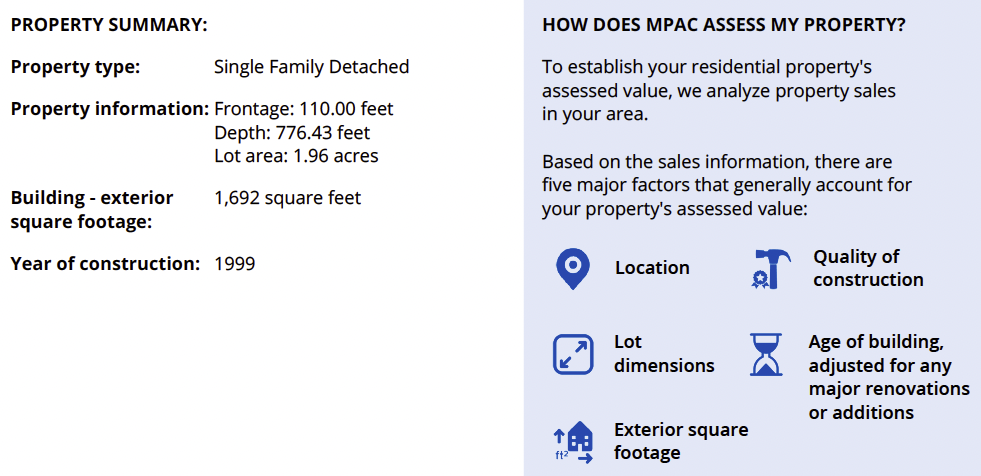

Property summary

Your assessment notice also shows some of your property details, including the property type, dimensions, building square footage and the year of construction, as well as an overview of the key factors we considered in assessing it.

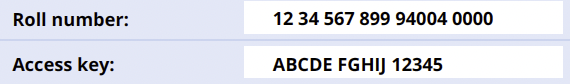

Learn more—your roll number and access key

Your Property Assessment Notice also includes information about how you can learn more about your specific assessment. You can use the access key and your roll number from this section to log in to AboutMyProperty to see the information we have on file for your property and compare it to others in your neighbourhood. Learn more about what else you can do there.

How to let us know if you disagree with your assessment

The notice includes specific instructions for letting us know that you don't agree with your property's assessed value or classification, and includes the deadlines for submitting a Request for Reconsideration.

You can also see more detailed information on what to do if you disagree with your assessment.