From spacious homes to compact condos: MPAC data reveals shifting housing trends across Ontario

Housing development across Ontario has undergone significant shifts in recent decades, reflecting an evolving economy, changing consumer preferences for housing type, and affordability considerations of current and prospective homeowners. According to new data released by MPAC (the Municipal Property Assessment Corporation), the types of homes and sizes have evolved across the province, highlighting regional variability in housing patterns.

Housing types over the years

While single-detached houses were once the dominant housing type in Ontario, comprising about 95 per cent of new homes built in the 1950s, mid- and high-rise condominium development activity began to rise starting in the 1960s and intensifying in the 1990s. By 2020, condo development had surpassed single-detached houses, with approximately 41 per cent of new residential builds being condos and around 38 per cent being single-detached.

“While new single-detached houses still make up a significant portion of new builds across Ontario, construction of this residential form has declined, especially in urban areas like the GTA,” said Greg Martino, Vice President and Chief Valuation and Standards Officer for MPAC. “This shift reflects evolving market dynamics, affordability challenges and the rise of higher-density urban centers”.

Property sizes reflecting residential market dynamics

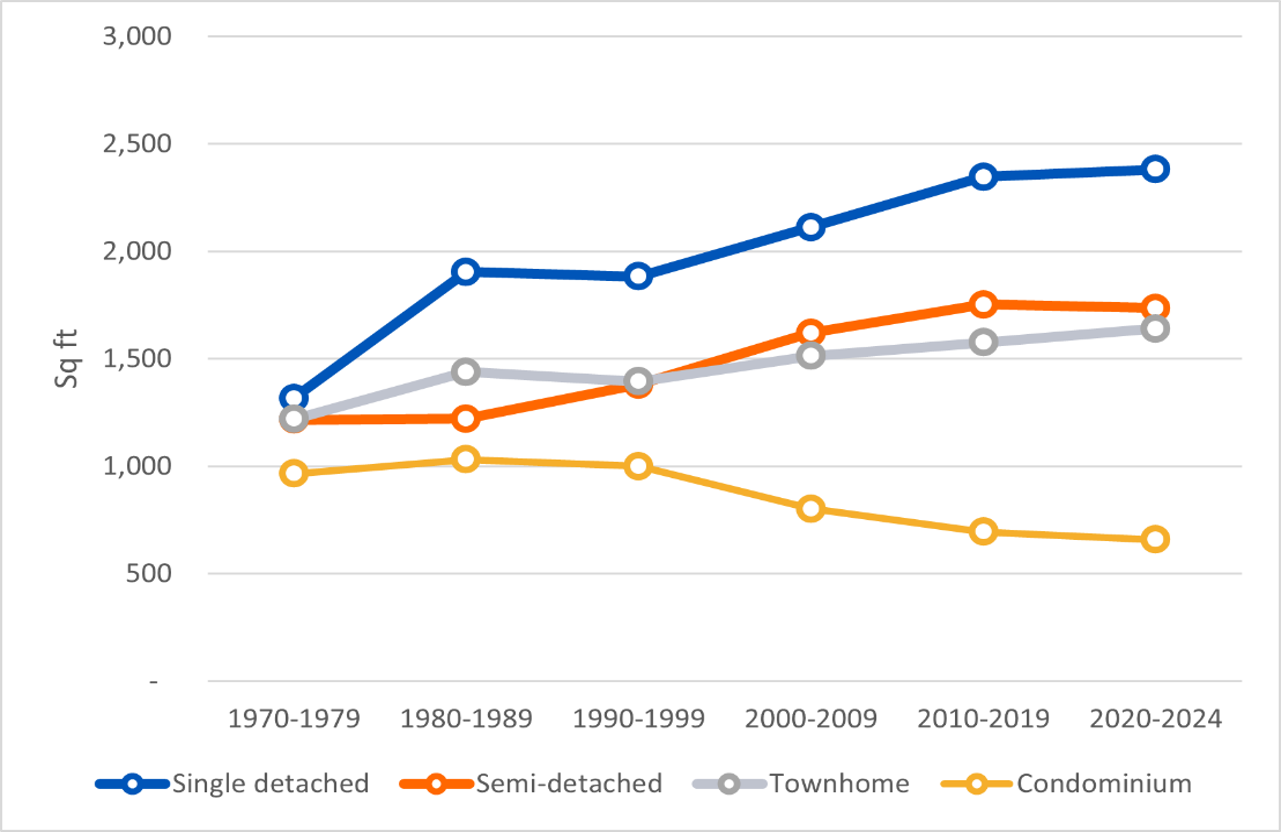

The shift toward larger single-detached houses and smaller condos has become increasingly common. Single-detached houses have grown from a median size of 1,317 sq ft in the 1970s to 2,383 sq ft in the 2020s, providing for more spacious living. The most significant growth occurred between the 1970s and 1980s, with a 44 per cent increase, and continued steadily through the 2000s and 2010s. This trend highlights the ongoing desire for larger single-family homes over the decades.

On the other hand, the median condo size has decreased by 32 per cent, shrinking from 965 sq ft in the 1970s to 658 sq ft today. This consistent reduction of overall size reflects the rising costs of construction, land acquisition costs due to scarcity, and the appeal of condos as investment properties. As a result, modern condominiums are now significantly smaller than they were 50 years ago.

Semi-detached and townhouses have seen modest size increases, reflecting their role as a middle-ground housing option. Townhouses have steadily increased from 1,220 sq ft in the 1970s to 1,640 sq ft in the 2020s, a growth of about 35 per cent over five decades, while semi-detached houses have increased by about 43 per cent over the same period.

Regional patterns: Large homes vs. mixed-size condos

When it comes to single-detached houses, King Township ranks at the top of the list for the largest new home builds from 2020 to 2024, boasting a median size of 4,716 sq ft. North York follows closely with a median size of 3,824 sq ft.

| Rank | Municipality | Median area (sq ft) |

|---|---|---|

| 1 | King | 4,716 |

| 2 | Toronto - North York | 3,824 |

| 3 | Mississauga | 3,680 |

| 4 | Richmond Hill | 3,429 |

| 5 | Vaughan | 3,382 |

| 6 | LaSalle | 3,197 |

| 7 | Aurora | 3,162 |

| 8 | Oakville | 3,114 |

| 9 | Erin | 3,096 |

| 10 | Puslinch Township | 3,079 |

*The data presented above pertains to new single-detached units constructed between 2020 and 2024, where at least 50 units have been built during the period.

A mix of large cities and smaller towns continues the trend of building smaller condos, which could be due to affordability and entry into home ownership. Some municipalities are defying this trend and are opting to build larger mid/high-rise condo units. These are primarily in smaller markets outside of the GTA.

Cities and towns with the smallest median square footage for new condos include:

| Rank | Municipality | Median area (sq ft) |

|---|---|---|

| 1 | Kingston | 483 |

| 2 | Gravenhurst | 530 |

| 3 | Oshawa | 577 |

| 4 | Lincoln | 599 |

| 5 | Waterloo | 605 |

| 6 | Toronto (city prior to amalgamation) | 616 |

| 7 | Toronto - North York | 638 |

| 8 | Kitchener | 646 |

| 9 | Vaughan | 647 |

| 10 | Brampton | 651 |

*The data presented above pertains to new condominium apartment units constructed between 2020 and 2024, where at least 50 units have built during the period.

Cities and towns with the largest median square footage for new condos include:

| Rank | Municipality | Median area (sq ft) |

|---|---|---|

| 1 | St. Catharines | 1,412 |

| 2 | London | 1,315 |

| 3 | Centre Wellington | 1,274 |

| 4 | Gananoque | 1,183 |

| 5 | Cobourg | 1,179 |

| 6 | Lakeshore | 1,163 |

| 7 | Huntsville | 1,163 |

| 8 | Pelham | 1,161 |

| 9 | New Tecumseth | 1,156 |

| 10 | Collingwood Town | 1,150 |

*The data presented above pertains to new condominium apartment units constructed between 2020 and 2024, where at least 50 units have been built during the period.

The variability in housing development is driven by several factors, including market demand, affordability concerns and local planning policies.

“As Ontario continues to grow and evolve, it’s important to recognize how changing market factors and consumer preferences will impact housing needs,” says Martino. “Tracking housing trends helps municipalities create strategies that address both current and future demands.”

MPAC’s comprehensive property data offers valuable insights into Ontario’s housing landscape, helping municipalities, developers and residents make informed decisions. With a deep understanding of regional property trends, MPAC aims to support public awareness of how housing development shapes the future of communities across the province.

About MPAC

MPAC is an independent, not-for-profit corporation funded by all Ontario municipalities, accountable to the Province, municipalities and property taxpayers through its 13-member Board of Directors.

Our role is to accurately assess and classify all properties in Ontario in compliance with the Assessment Act and regulations set by the Government of Ontario. We are the largest assessment jurisdiction in North America, maintaining an inventory of more than 5.6 million properties with an estimated total value of more than $3.1 trillion.