Industry Association Toolkit

To help business property owners understand the important role they play in complying with MPAC’s information requests, and highlight the enhancements we’ve made to the submission portal in AboutMyProperty, we have curated content you can share on your website, in newsletters, and across social media channels.

This year’s annual Property Income and Expense Return campaign runs from May 20 to July 14. Please consider sharing this information during that timeframe.

Newsletter/web copy

We have created newsletter content/ web copy associations can use to promote the Property Income and Expense Return (PIER) campaign to their members.

|

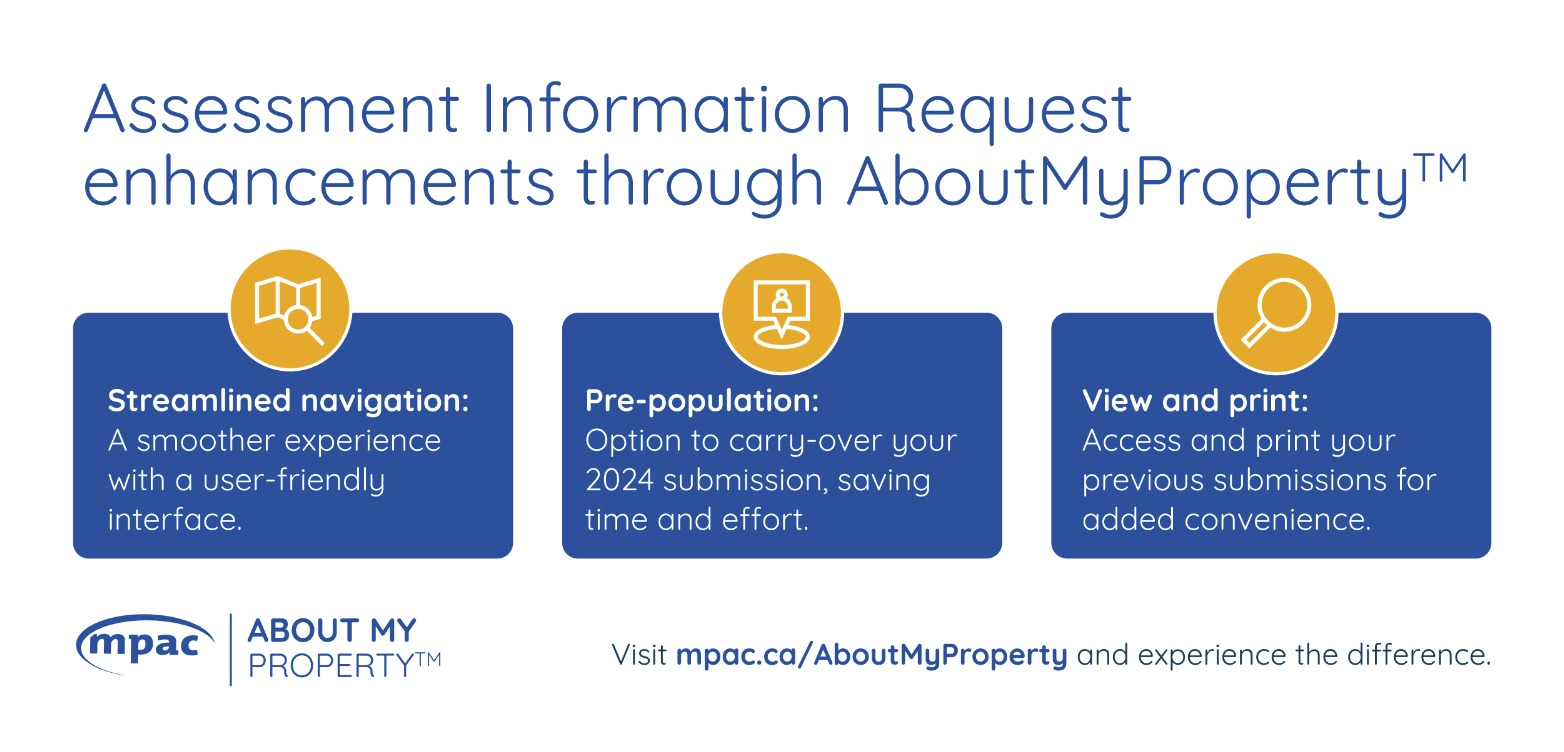

MPAC introduces information request portal enhancement in AboutMyProperty™ The Property Income and Expense Return is their largest information request campaign, where MPAC requests rental, income and expense information from income-generating properties such as retail stores, hotels, motels, multi-residential properties, golf courses and offices. Starting May 20, eligible property owners will receive an information request letter from MPAC outlining what information is needed and details on how to submit it. The submission deadline is July 14, 2025. This year, MPAC has made it easier than ever to provide information online through AboutMyProperty. The enhanced information request portal offers:

As a property owner, you have an important role to play in providing the information requested by MPAC, which is a requirement of the Assessment Act. By submitting your information on time, you can help ensure the unique details of your property are accurately reflected. To learn more or for additional information on how to submit your information, visit mpac.ca/AIR. |

Reshare our social media content

Click the links below to reshare MPAC’s social media posts across your channels.

Leverage new content for your social channels

We have created original content below for X, Facebook, LinkedIn, and Instagram. You can also use this information in newsletters and on your website.

| Platform | Copy |

|---|---|

| X |

Receive a Property Income and Expense information request letter from @MPAC_Ontario? 📄 As a property owner, you have an important role to play in providing accurate, timely, and complete information. Submit the requested information via MPAC's redesigned portal in #AboutMyProperty by July 14. 💻 Learn more: www.mpac.ca/AIR. |

|

LinkedIn and Facebook |

Receive a Property Income and Expense information request letter from the Municipal Property Assessment Corporation [TAG]? 📄 As an Ontario property owner, you know your property best! Easily submit accurate, timely, and complete information—an Assessment Act requirement—via MPAC’s newly redesigned information request portal in #AboutMyProperty on www.mpac.ca by July 14. 💻 MPAC’s information request portal in #AboutMyProperty now offers features like streamlined navigation, the option to carry-over your 2024 submission, and the ability to view and access past submissions for added convenience. For more information, visit www.mpac.ca/AIR. |

|

|

Receive a Property Income and Expense information request letter from the Municipal Property Assessment Corporation? 📄 As an Ontario property owner, you know your property best! Easily submit the requested information—an Assessment Act requirement—via MPAC’s newly redesigned information request portal in #AboutMyProperty 💻 on www.mpac.ca by July 14. For more information, visit www.mpac.ca/AIR. |

Graphics

Include a graphic with your content. Right-click to save and download.

|

|

|

|

|

|

Video

Share the promotional video with property owners for additional details about the information request portal enhancements in AboutMyProperty.

Ready-to-print buck slip

To enhance your communication with property owners, we have designed a ready-to-print buck slip on the Property Income and Expense Return enhancements. You can include it in your mailings to your members, use it as a graphic in your newsletter, or feature it on your website.

Click here to download the print-ready PDF.